APS: Perspectives

Advertisment

This question is polymorphic in nature. It has different set of answers depending

on perspective of the person who is asking this question. Here, we have answered

them by grouping in various possible perspectives.

Investors' Experience Perspective

|

Novice

you are a novice investor and interested in investing in the stock market. However,

you are scared because of the loss making stories. Please visit the following link

to know the complete picture and how APS can help you.

APS for Novice Investors

|

|

|

Fixed Deposit & Bond Investor

If you are a Fixed Deposit investor and prefer to be secure than uncertain, please

visit the following link to get a new perspective.

APS for Secure

Investors

|

|

Busy Executive

If you are a very busy investor (Top CEO or Govt. Officer) and do not have time

to manage your investment. Please visit the following link to know what you are

missing and how APS can help you.

APS for Busy Executives

|

|

|

Bad Investment Experience

If you have bad stock market investment experience in the past. Please visit the

following link to read our analysis. May be we have covered your story here with

smart solution.

APS for

Bad Experience Investors

|

|

Smart Investor

If you are a successful investor who knows the rules of the game, APS can be a very

good assistance to you to save time and improve ROI. Please visit the following

link.

APS

for Smart Investors

|

|

Checkout

How It Works for more details

about exact steps to subscribe and use APS.

Changing Technology Perspective

|

Do you still use telegram?

|

Or

|

Do you send SMS/WhatsApp?

|

|

|

Do you still book ticket standing in queue?

|

Or

|

Do you book ticket online?

|

|

|

Do you still do library search?

|

Or

|

Do you Google Search?

|

|

Technology has already switched our life-style to better, faster and cheaper options

then why still follow conventional mode of investment?

Active Portfolio Service (APS) has introduced similar breakthrough change for retail

investors. It helps them to leverage the power of technology to manage their investments

in a better, faster and cheaper way

APS works as ultimate tracking system for your current holdings in the market as

well as swift radar system for identifying opportunities available in the market.

Checkout

How It Works for more details

about exact steps to subscribe and use APS.

Features Perspective

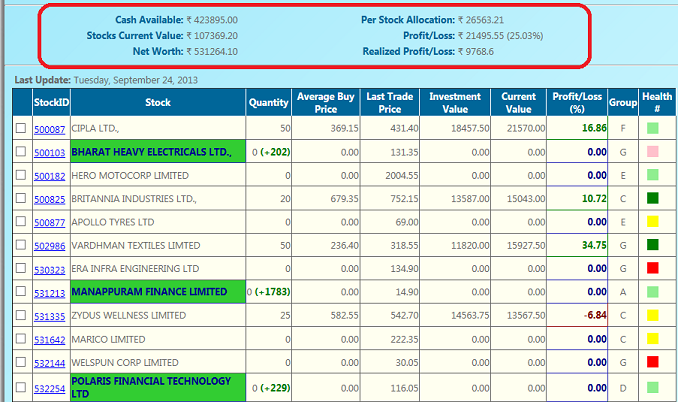

Single Point Dash Board

APS provides a single point dash board to see the status of profit loss, cash availability

and health of individual stocks owned by investors.

Intelligent Portfolio Builder

Intelligent Portfolio Builder

APS subscribers get information rich PortfolioBuilder tool. Apart from helping in

building a balanced & truly diversified portfolio it also provides information of

each stock's past performance and current health in the most convenient way.

Portfolio Builder also works as radar system to alert subscribers about opportunities

available beyond their registered set of stocks. It covers top 500 stocks on radar

and alerts investors if it senses opportunity at any moment according to Rule-X

(see Stock Name in

Green color

with * marked). Hence, subscriber of this service almost never miss any opportunity.

Rule-X Based Alert Service

We understand investors are very busy individuals. Our approach lets their portfolio

speak about health and status of the stocks rather than the need to follow them

all the time.

APS provides Rule-X (See

Secret Behind)

based alert service. Investors get weekly detailed report through email as well

as short report through SMS. It tracks the stocks where the investors have invested

as well as where investor would like to invest in future.

Check out

Case Studies to realize how important

role such alert services play for investors.

Checkout

How It Works for more details

about exact steps to subscribe and use APS.

Investment Modes Perspective

Compare

|

APS

|

Fixed Deposit

|

Mutual Fund

|

|---|

Statistical ROI

(in last 5 years);

|

21%

(80% Investors in the range of 15-26%)

|

~6% (After tax)

|

Majority of Mutual funds below 4%

|

|---|

Is it free from entry/exit barrier?

|

|

Sometime

|

|

|---|

Is there some yearly overhead cost?

|

Negligible (Less than 1% for investment of more than 4 lakh)

|

Nil

|

Around 3% (Watch out expense ratio of your mutual fund)

|

|---|

Can investors protect themselves in case of confirmed bad news on short notice?

|

|

Not Required

|

No! Often regulation, internal policies, and organizational inertia are big inhibitors

|

|---|

Chances of past performance repeat.

|

Most likely! APS data is based on broader statistical parameters. We do not focus or recommend specific stock(s). Hence, our approach is more like insurance companies.

|

Almost without much variation

|

Not guaranteed.

|

|---|

Can I hedge using F&O for uncertainty at fixed point of time?

|

|

Not Required

|

|

|---|

Checkout

How It Works for more details

about exact steps to subscribe and use APS.

Investment Channels Perspective

Compare

|

APS

|

PMS

|

Stock Tips (Paid or Free from TV news)

|

|---|

Past Performance Verification

|

Provides all necessary data and tool to validate.

|

Either trust the person or need to validate through some other sources

|

Almost no way one can validate.

|

|---|

Do they take care of balancing the portfolio?

|

|

Probably

|

|

|---|

Do they take care to provide exit signal on time?

|

|

Not Required

|

No! They just provide tips and exit criteria at the same time, often tough for investors to follow the same.

|

|---|

Do they take care of my budget?

|

|

Not Required

|

|

|---|

Service Charge

|

Negligible (Less than 1% for investment of more than 4 lakh)

|

Often 2% fixed + 20% of your profit. Nearly 6% (assuming they also give 20% yearly return)

|

Anywhere between 2-4% for investment of 4 lakh. Free? There is no free lunch in finance.

|

|---|

Control on money

|

It is all the time in investors' hand

|

Often need to transfer money to their account.

|

|

|---|

Can I hedge against F&O?

|

|

|

No!

Reasons: 1. They hardly take long term investment approach

2. Often stocks are beyond F&O segments

|

|---|

Checkout

How It Works for more details

about exact steps to subscribe and use APS.

|

|

Life without APS

|

Life with APS

|